MERRY CHRISTMAS

Have a Merry Christmas and Happy New Year. Try Zappy Compliance a new way of Compliance Calendar that will help you maintain Statutory Registers, Minutes Books and other Repositories online at ease in a safe and secure way.

In this edition, we will be seeing about Monitoring and Disclosures by Debenture Trustee(s). We will have our usual Legal terms and News Bites related to notifications by MCA, SEBI, RBI, IT and GST following the article.

![]() CS Saranya Deivasigamani,

CS Saranya Deivasigamani,

CEO

DEBENTURE TRUSTEE(S)

SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 and SEBI (Debenture Trustees) Regulations, 1993 (“DT Regulations”) now mandates issuers to submit information/ documents to Debenture Trustees. In order to enable debenture trustees to discharge its obligations in respect of listed debt securities, the debenture trustees shall undertake independent periodical assessment of the compliance with covenants or terms of the issue of listed debt securities including for ‘security created’.

Monitoring of ‘security created’ / ‘assets on which charge is created’

SEBI Circular No. SEBI/ HO/ MIRSD/ CRADT/ CIR/ P/ 2020/218 dated November 03, 2020, has prescribed the manner in which debenture trustees shall carry out due diligence for creation of security at the time of issuance of debt securities and as required under Regulation 15(1)(s) & 15(1)(t) of DT Regulations, debenture trustee(s) shall carry out due diligence on continuous basis. Debenture trustee shall carry out periodical monitoring in following manner

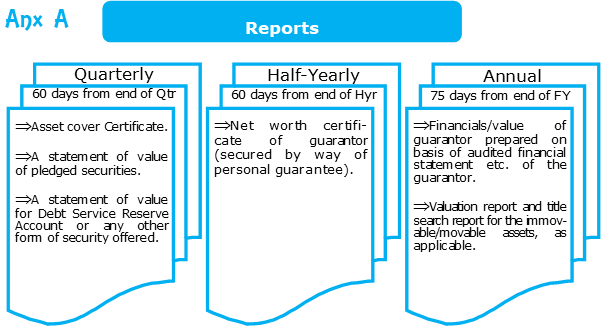

Debenture trustee shall incorporate the terms and conditions of periodical monitoring in the debenture trust deed wherein listed entity shall be liable to provide relevant documents/information, as applicable, to enable the debenture trustees to submit the reports/certification given in Anx A to Stock Exchanges within the timeline.

For existing debt securities, listed entities and debenture trustee(s) shall enter into supplemental/amended ebenture trust deed within 120 days from the date of November 12, 2020 incorporating the changes in the debenture trust deed.

In case, a listed entity has more than one debenture trustee for its listed debt securities, then debenture trustees may choose a common agency for preparation of asset cover certificate.

Action to be taken in case of breach of covenants or terms of issue

In case of breach of covenants or terms of the issue by listed entity, the debenture trustee shall take steps as outlined in para 6.1 and 6.3 of SEBI Circular SEBI/HO/MIRSD/CRADT/CIR/P/2020/203 dated October 13, 2020 and thereafter take necessary action as decided in the meeting of holders of debt securities in this regard.

Disclosure on website by debenture trustee

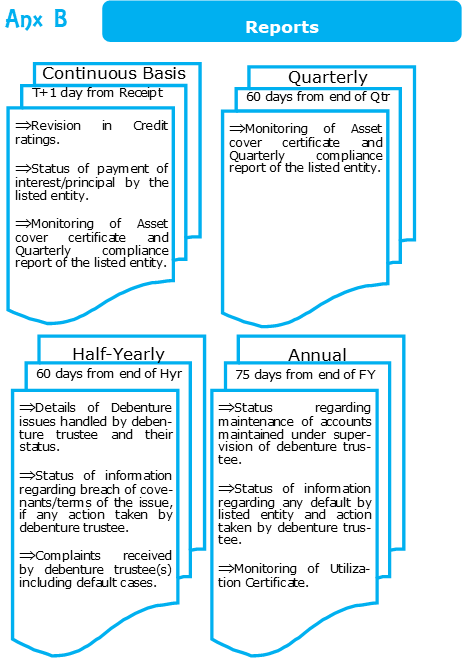

The debenture trustee(s) shall make the following disclosures on their websites as specified Anx B.

Reporting of regulatory compliance

The formats for periodical reporting prescribed by SEBI Circular No. CIR/MIRSD/25/2011 dated December 19, 2011 stands rescinded and the debenture trustee(s) shall furnish revised 3 Half-Yearly reports to SEBI within 30 days of the end of each half-year such as: Half yearly compliance report; Details of other activities carried out by Debenture Trustee(s) including type of activity, description of activity etc. and Risk-Based Supervision report.

Applicability

These provisions will come into force w.e.f. quarter ended December 31, 2020 for listed debt securities.

Legal Terms

Pactum

An informal agreement between two or more persons containing one or more promises and usually legally unenforceable.

MCA Updates

- Companies (Auditor’s Report) Second Amendment Order, 2020.

- Companies (Compromises, Arrangement and Amalgamations) Second Amdt Rules 2020.

- Companies (Appointment and Qualification of Directors) Fifth Amendment Rules 2020.

SEBI Updates

- Master Circular on (i) Scheme of Arrangement by Listed Entities and (ii) Relaxation under Sub-rule (7) of rule 19 of the SCRA, 1957

- Core Settlement Guarantee Fund, Default Waterfall and Stress Test for LPCC

- Review of inclusion of Historical Scenarios in Standardized Stress Testing in Commodity Derivatives Segment

- Framework for issue of Depository Receipts – Clarifications

- e-Voting Facility Provided by Listed Entities

- Additional Payment Mechanism (i.e. ASBA, etc.) for Payment of Balance Money in Calls for partly paid specified securities issued by the listed entity.

- Operational guidelines for Transfer and Dematerialization of re-lodged physical shares

- Testing of software used in or related to Trading and Risk Management

- Introduction to UPI

- Amendments to guidelines for preferential issue and institutional placement of units by a listed InvIT.

RBI Updates

- Opening of Current Accounts by Banks – Need for Discipline

- Regional Rural Banks – Access to Call/Notice/Term Money Market

- External Trade – Facilitation – Export of Goods and Services

- Introduction of Liquidity Adjustment Facility (LAF) and Marginal Standing Facility (MSF) for Regional Rural Banks (RRBs)

- Declaration of dividends by banks

- Processing of e-mandates for recurring transactions

- Maintenance of Escrow Account with a Scheduled Commercial Bank

- FEMA- Compounding of Contraventions under FEMA, 1999

IT Updates

GST Updates

- Auto population of details in Form GSTR-3B from Form GSTR 1 & GSTR 2B

- GSTR-9 of FY 2019-20 is available now

- Winners of GST-n-You Contest, 2020 on Benefits of GST held by GSTN

- Update on auto-population of e-invoice details into GSTR-1

- Online filing of application (Form GST EWB 05) by the taxpayer for un-blocking of E-Way Bill (EWB) generation facility

- Salient features of Quarterly Return filing & Monthly Payment of Taxes (QRMP) Scheme

- Updates on e-invoicing

- Update on Blocking of E-Way Bill (EWB) generation facility, after 1st December, 2020

'

'